If you have forgotten your PIN number please call us (502) 564-7287.

#State of ct tax tables 2020 software

To transmit W-2 files electronically, please visit įilers who registered to use the FTP software from previous years are already registered to use the web site. To register, please fill out the Form 42A808 - EFW2 PIN and return it us. Submission of Wage and Tax information must be filed on or before January 31.ĭepartment of Revenue will assign a personal identification number (PIN) when the employer declares an intention to send annual wage and tax reports to Department of Revenue via the Web. This method is offered at no cost to the employer. Taxpayers may file returns, view previously filed online returns, amend returns, request refunds and credit forwards as well as the ability to access the Enterprise Electronic Payment System for paying Withholding Tax Due. E-file W-2sĭepartment of Revenue allows employers to submit wage and tax information via the internet as an alternative method of submitting the Report of Employees Annual Wage and Tax Information. The Withholding Return and Payment System (WRAPS) provides the taxpayers of the Commonwealth the ability to file their Withholding K-1 and K-3 returns online.

This barcode is used by DOR to process the form more accurately and efficiently.įiling Withholding Taxes File Online Returns

Note: When printing the form to mail to DOR, a barcode will print at the bottom of the form. However, the print and mail option is only for those reporting fewer than 26 withholding statements. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

#State of ct tax tables 2020 full

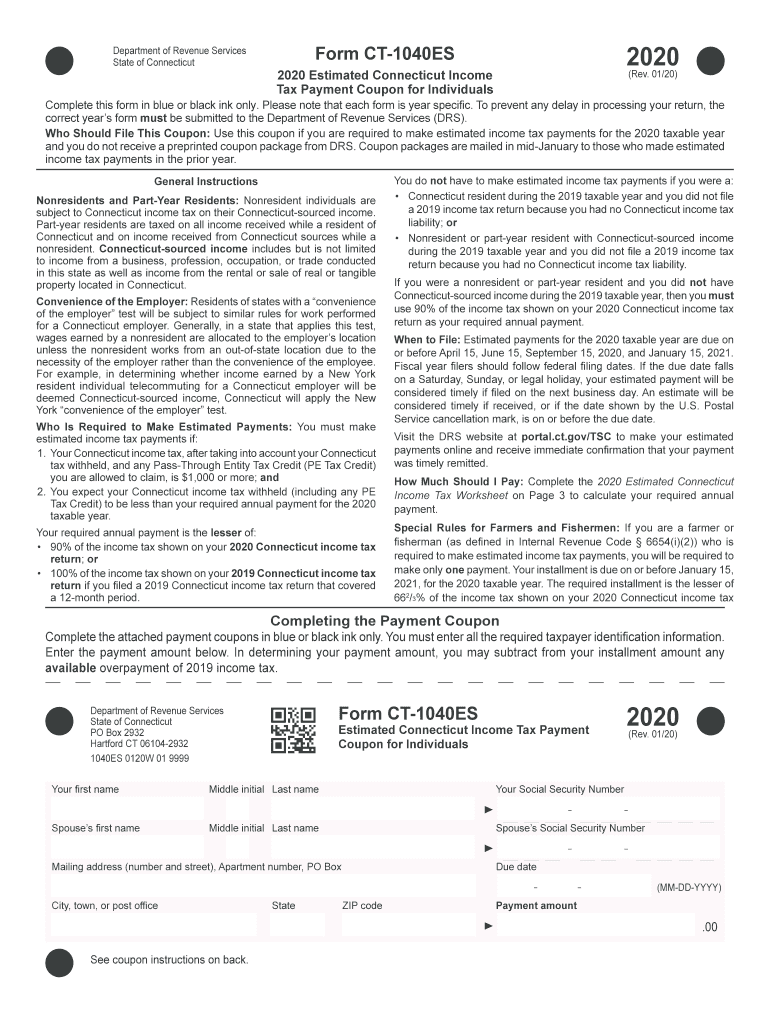

The Connecticut State Tax Tables below are a snapshot of the tax rates and thresholds in Connecticut, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Connecticut Department of Revenue website.

This page contains references to specific Connecticut tax tables, allowances and thresholds with links to supporting Connecticut tax calculators and Connecticut Salary calculator tools. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. The Connecticut Department of Revenue is responsible for publishing the latest Connecticut State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Connecticut. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Connecticut State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Connecticut State Tax Calculator.

0 kommentar(er)

0 kommentar(er)